Mistakes happen, sure. But should companies expect employees to accept errors with their payroll?

Not if they want to keep them. Rampant payroll errors don’t just drain businesses — they harm employees, too. According to a Morning Consult survey commissioned by Paycom, 86% of Americans would suffer a negative impact from just one missing or delayed check.

Any error could risk late pay under the right circumstances. At the same time, it’s tough to build rapport with a workforce when communication with HR often revolves around erroneous paychecks and failing processes. After all, HR can only be so confident when they’re fielding questions like:

- “Why haven’t I been reimbursed for the conference I went to three months ago?”

- “Why was I charged twice for my insurance in the same pay period?”

- “Shouldn’t I be getting taxed?”

- “What happened to my approved overtime pay?

- “I didn’t get paid last Friday. What’s going on?”

It’s no wonder 91% of HR professionals told OnePoll in a study commissioned by Paycom that payroll mistakes break trust between employees and employers.

If payroll errors are so detrimental, they can’t be that common, right? Wrong. Especially when you consider Ernst & Young’s (EY) survey of over 500 pros who work in payroll for U.S. companies with 250 to 10,000 workers. Businesses using a traditional payroll process — one that doesn’t let employees verify their pay’s accuracy before it runs — can expect a 20% error rate.

So what do payroll errors look like, and which ones hit the hardest and most frequently? Luckily, EY collected data on that, too. Let’s take a deeper look.

What are the most frequent payroll errors?

The volume of payroll errors an organization has changes depending on its industry, head count and other variables. For example, a fast-food restaurant supported by hourly, part-time employees won’t necessarily experience the same issues as a law firm filled with salaried attorneys.

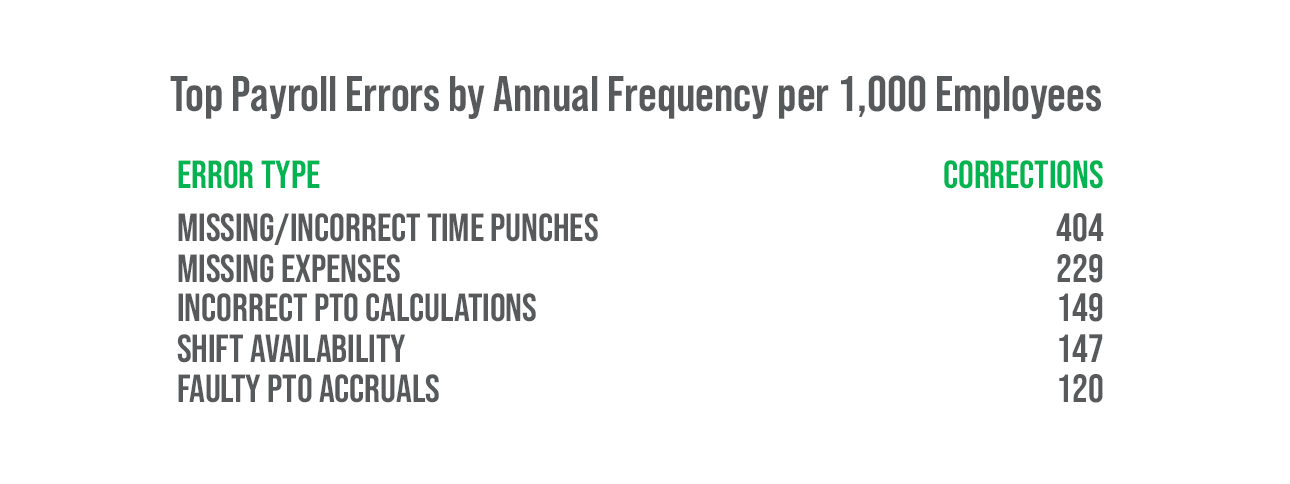

Even so, certain errors hold higher frequency across the board. Consider these five common payroll mistakes EY calculated the average company could face per year for every 1,000 employees:

1. Missing/incorrect time punches

If employees are expected to clock in, you can expect a flubbed punch every once in a while. Unfortunately, EY discovered “every once in a while” doesn’t capture the severity of this consistent botch: Businesses could expect 404 time-punch errors — that’s roughly four fixes for every 10 employees.

2. Missing expenses

Team outings. Work lunches. Business trips. These are just a few of the scenarios that call for an expense request. Of course, if there’s an opportunity to submit an expense, there’s a chance to leave the reimbursement out of an employee’s check. Especially with an outdated system. EY estimated businesses scramble to find 229 missing expenses, or about three per worker annually.

3. Incorrect PTO calculations

Employees who earn PTO will eventually take it, right? Absolutely, but they might think twice if they can’t trust their company to accurately record it. Employers miscalculate PTO 149 times, according to EY.

4. Shift availability

Headaches are inevitable when companies incorrectly schedule employees. But this pain morphs into a migraine for businesses relying on outdated payroll. EY estimated 147 errors involving hours and scheduling.

5. Faulty PTO accruals

It’s one thing to have inaccurate PTO. But businesses have an even bigger problem on their hands when it’s not accruing altogether. EY found PTO fails to accumulate an average of 120 times.

What are the most expensive payroll errors?

Every action HR takes correcting payroll has a price. And according to EY, they add up fast. In fact, the average error costs $291 to fix. A mistake could entail any combination of:

- voids

- wire transfers

- last-minute audits

- rushed paper checks

- long conversations with employees

It doesn’t take long for a swarm of mistakes to eat away at an organization’s revenue. After a one-year study of a 1,000-employee company, EY estimated the annual cost of rectifying the business’s payroll errors was $922,131.

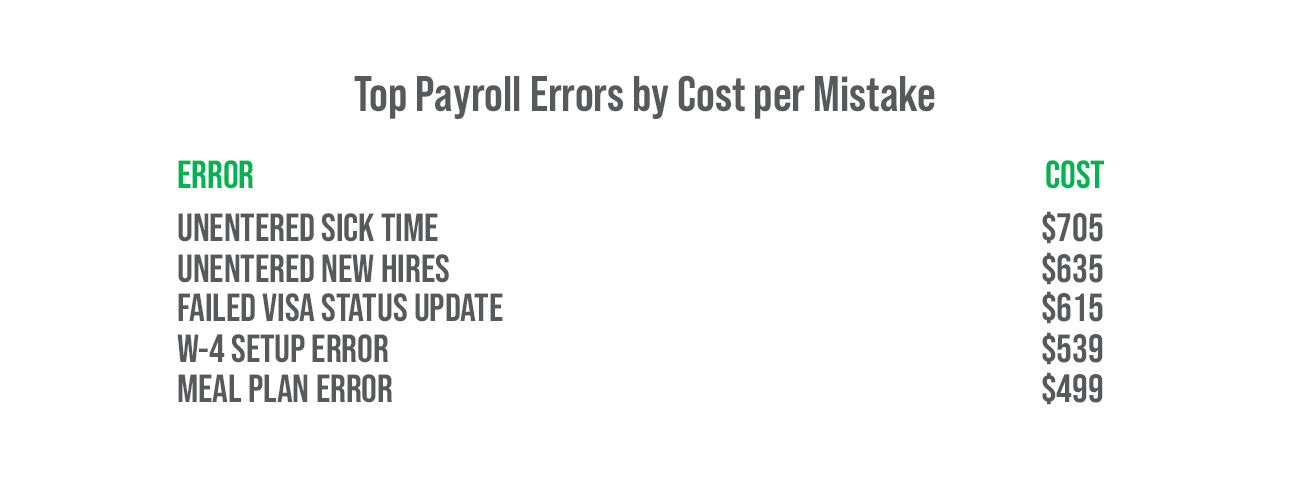

How did the company rack up such a terrible tab? On average, EY calculated these to be the costliest payroll mistakes:

1. Unentered sick time

Employees accumulate sick time for when they need it most. Coincidentally, it’s also the most expensive payroll mistake when it goes missing. EY found addressing unentered sick time costs companies $705 per incident.

2. Unentered new hires

Picture this: You just found a fantastic candidate. After a few weeks, you’re confident you made the right call. You’re making your way through the workplace, ready to congratulate their early excellence and … you see them in HR’s office as you pass by. They look panicked, and for good reason. They didn’t get a check on their first payday.

It happens more often than you think. Besides the panic and broken trust, unentered new hires also put companies out $635 per employee.

3. Failed visa status update

Depending on your industry, there’s a chance you rely on employees from across the globe. That’s great for a ton of reasons! But when updating visas goes wrong, it’s horrible for a company’s budget. Each visa status update error costs $615 on average.

4. W-4 setup error

If you run a business, you’ve dealt with taxes. It can already be a challenge to ace compliance without the right support. Stacking an outdated payroll process on top of it? That makes a critical process more complicated and costlier.

When it comes to one of the most common tax documents — the W-4 — fixing an incorrect form typically costs $539.

5. Meal plan error

Free or subsidized meals are usually an awesome perk. But when they’re improperly applied to payroll, it’s the equivalent of a culinary disaster. The average meal plan error costs $499 to fix.

What are the most time-consuming payroll errors?

What could your business accomplish in half a year? Maybe it’s rolling out a game-changing campaign or an impressive new employee wellness initiative. Whatever it is, you probably want it to be more productive than fixing payroll errors that could be prevented.

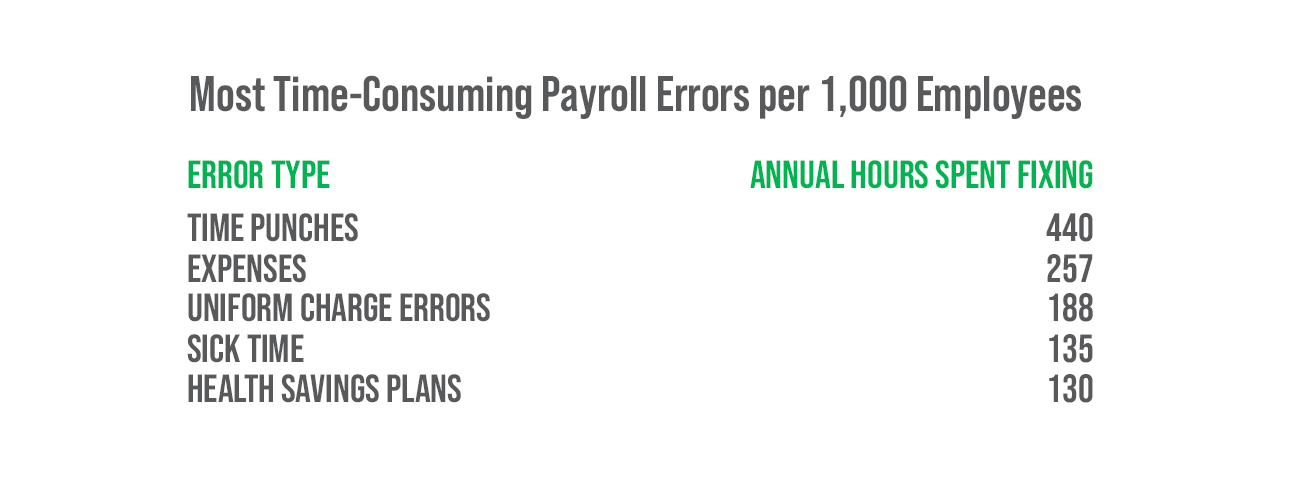

Payroll professionals would likely agree, given they waste an average of 29 full-time workweeks a year correcting payroll, according to EY. So where does that time go exactly? Here are the five most prolific time thieves of a 1,000-employee company per year:

1. Time punches

Given they’re the most common error, it may come as no surprise that faulty time punches are also the most time-consuming. EY estimated businesses lose roughly 440 hours — 11 workweeks — fixing these issues.

2. Expenses

Employees expect to get reimbursed. When it doesn’t happen correctly, payroll pros can expect hours of trying to make things right. Specifically, EY counted an average of 257 hours for companies to address erroneous expenses.

3. Uniform charge errors

Ideally, something consistent wouldn’t need to be corrected very often, right? Maybe not, but in the seemingly off chance a uniform charge issue derails payroll, EY found it could waste 188 hours of HR’s time.

4. Sick time

The cost of fixing unentered sick time is already nauseating. And the time it takes to do so won’t sit on an employer’s stomach well either. EY discovered organizations sink 135 hours into fixing sick time errors.

5. Health savings plans

Health savings accounts (HSAs) can come in handy for employees who anticipate regular medical expenses or even those saving for operations like LASIK. When these plans are miscalculated, however, businesses lose 130 hours correcting them.

How do companies prevent payroll errors?

While companies can’t technically stop payroll mistakes, they can prevent their consequences. All it takes is catching them early. It might sound odd or even impossible, but it’s easier than you think.

In fact, most employees demand this capability. In a Morning Consult survey commissioned by Paycom, 70% of employees said the ability to view their payroll and fix errors before payday improves their financial outlook and job satisfaction. So how do businesses deliver on this expectation?

Consider HR tech like Beti®, for example. It’s Paycom’s employee-driven payroll experience. It automatically leads workers to find and fix payroll errors before payroll runs. This prevents unchecked mistakes from harming your employees and the bottom line.

Read our white paper to dig into the staggering consequences of payroll errors. And explore Beti to learn how it gets ahead of costly mistakes.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.