Tax Credits

Effortlessly reduce or even eliminate your federal income tax liability with our tax credits software

HOW YOU BENEFIT

Tax credits service so you can benefit without the burden

Billions of dollars are available to companies and owners as federal tax credits, so why not take advantage of them? Paycom’s risk-free Tax Credits service identifies, secures and administers these government incentives available to improve your company’s financial performance — a dollar-for-dollar reduction, not a deduction. If no credits are located, you pay nothing for our search!

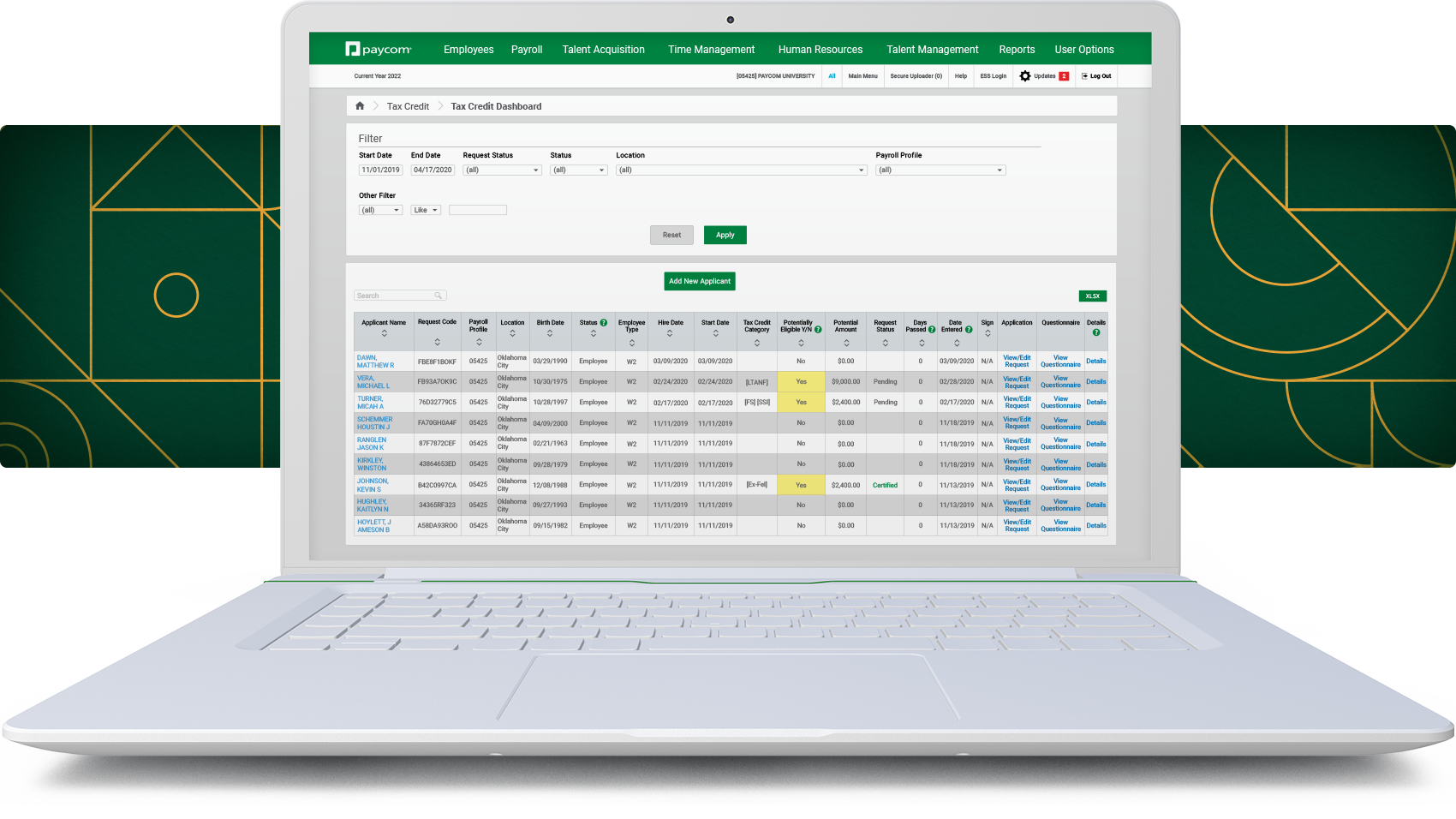

Work Opportunity Tax Credits (WOTC) provide a financial incentive for business leaders to hire workers from groups that typically face significant barriers to employment. This includes military veterans, residents in designated communities, ex-felons and more.

Paycom performs 95% of the work in implementing a successful WOTC tax credit strategy in which you, the owner, benefit from 100% of the savings. You can greatly reduce or even eliminate your federal income tax liability while lowering your effective corporate tax rate.

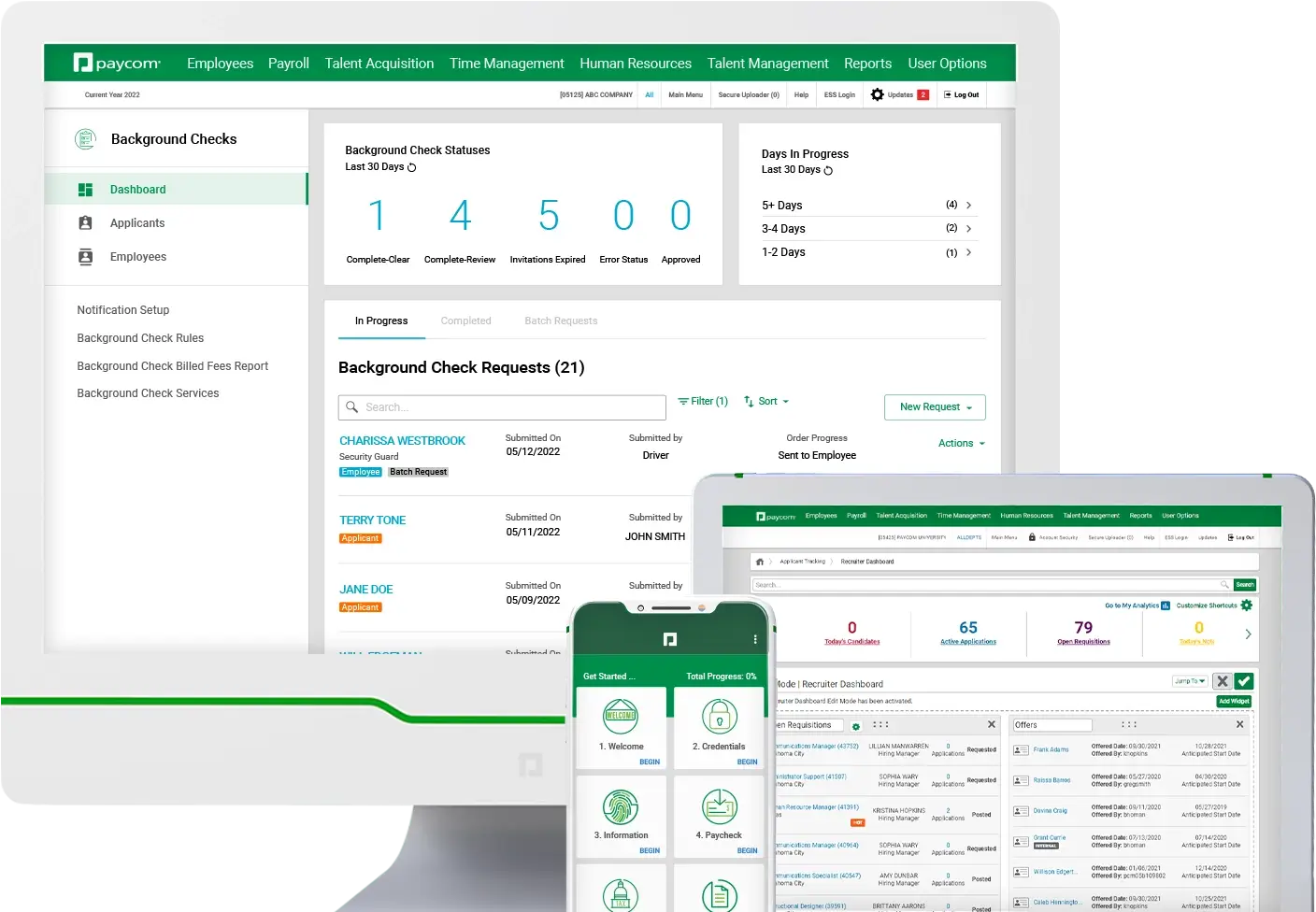

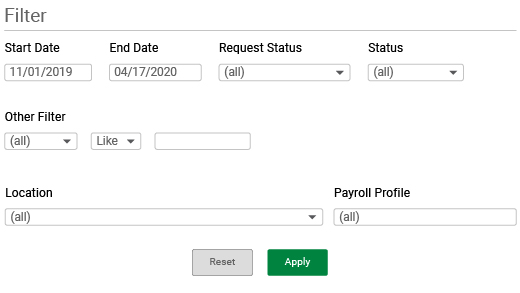

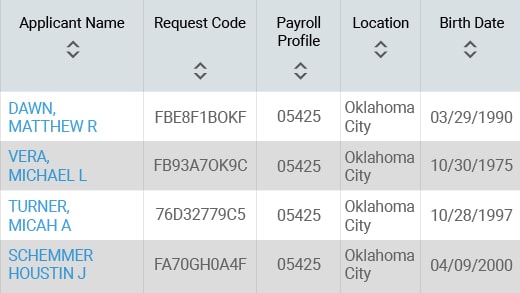

Job candidates are screened automatically upon entry into our Tax Credits software; you receive instant potential eligibility notifications for any number of credits. If none are generated, you pay nothing for the search. If credits are generated, you benefit from them 100%, for a nominal fee.

Understanding the ever-changing legislative process and tax code is critical. With our technology, expertise and relationships with federal agencies, we save eligible clients between tens of thousands and hundreds of thousands of dollars a year, depending on head count, with minimal effort on their part.

Available per-employee incentives include

- long-term Temporary Assistance for Needy Families (TANF), up to $9,000

- Supplemental Nutrition Assistance Program (SNAP) recipient, up to $2,400

- short-term TANF recipient, up to $2,400

- unemployed veteran credits, up to $5,600

- disabled veteran credits, up to $9,600

- ex-felon credit, up to $2,400

YOU MAY STAND TO PROFIT FROM ELIGIBLE TAX CREDITS

Over 6.5 million Americans rely on Paycom’s technology every year

Tax Credits Works well with

FREQUENTLY ASKED QUESTIONS

How Tax Credits helps businesses say 'goodbye' to HR woes

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to businesses that recruit and hire candidates who often face barriers to employment. Employers may meet their staffing needs and claim a tax credit by hiring a candidate in a WOTC-targeted group.

Common examples under WOTC include credits up to:

- $9,000 for long-term TANF recipients

- $9,600 for disabled veterans

- $5,600 for unemployed veterans

- $2,400 for short-term TANF recipients

- $2,400 for SNAP recipients

- $2,400 for ex-felons

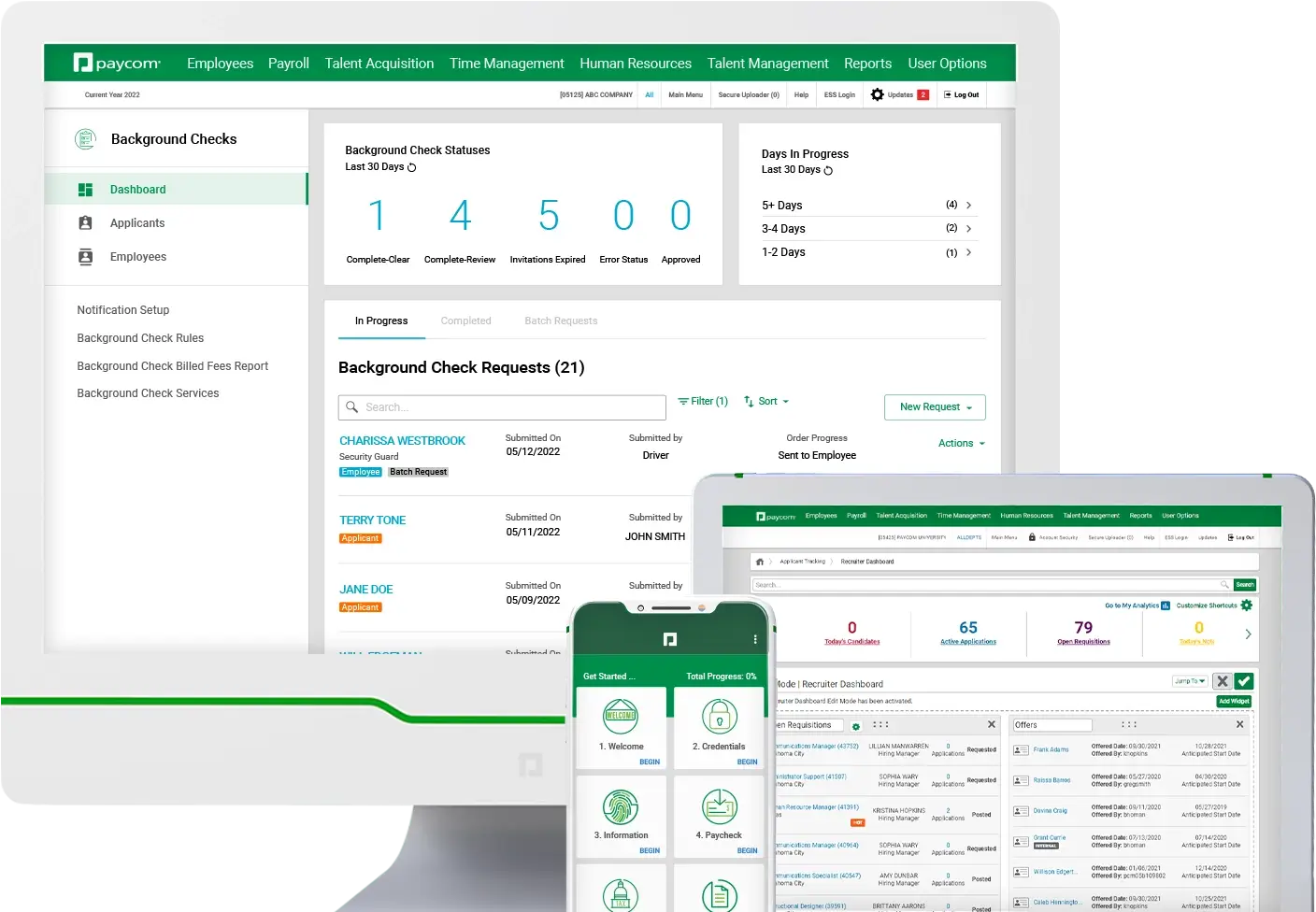

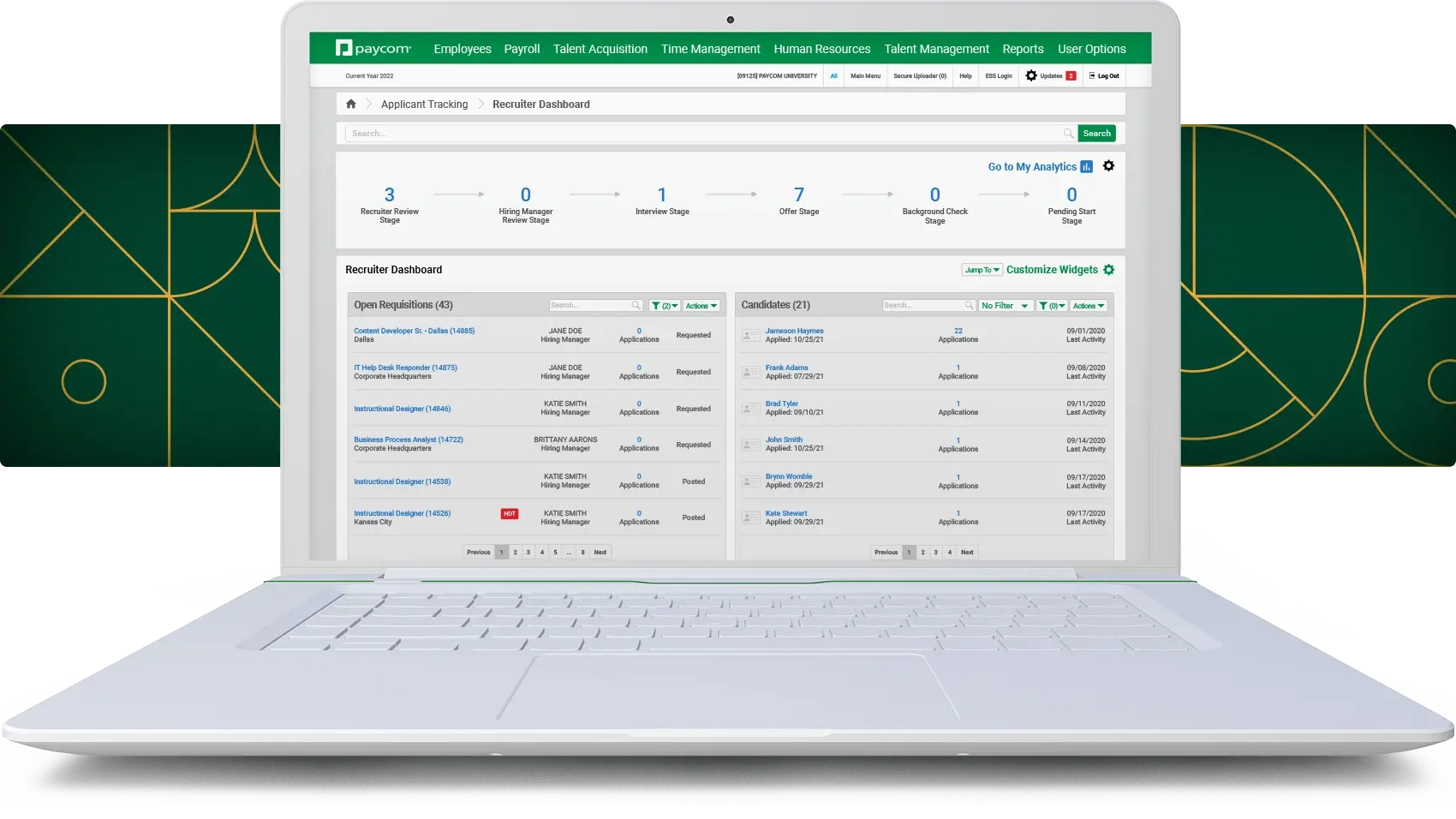

Once clients sign up for our Tax Credits service, we provide the forms they need qualifying applicants to complete. Clients with our Applicant Tracking software can add these forms digitally to their applications.

Per IRS guidance, WOTC forms need be completed on or before the day a candidate is offered a job. Clients can provide these forms through our Applicant Tracking software or secure uploader.

Clients can claim credits on their year-end tax return, not through a monetary payment. Paycom provides a year-end statement with all of the credits secured that year. We recommend clients provide this statement to a CPA or equivalent tax professional for filing.

Yes. Once we receive an employee’s forms, the client’s part is over. We then submit these forms to the appropriate state workforce agency or agencies.

Depending on a client’s hiring size, we help secure tens of thousands to hundreds of thousands of dollars each year, with little effort on their part. Because WOTC is a dollar-for-dollar reduction, not a deduction, some clients are able to eliminate their federal income tax liability for that year.

If Paycom finds clients are not eligible for tax credits, they pay nothing for our search.

For all your talent acquisition needs in a single software, request a meeting