Payroll software

Comprehensive payroll solutions to reward and reimburse employees

HOW YOU BENEFIT

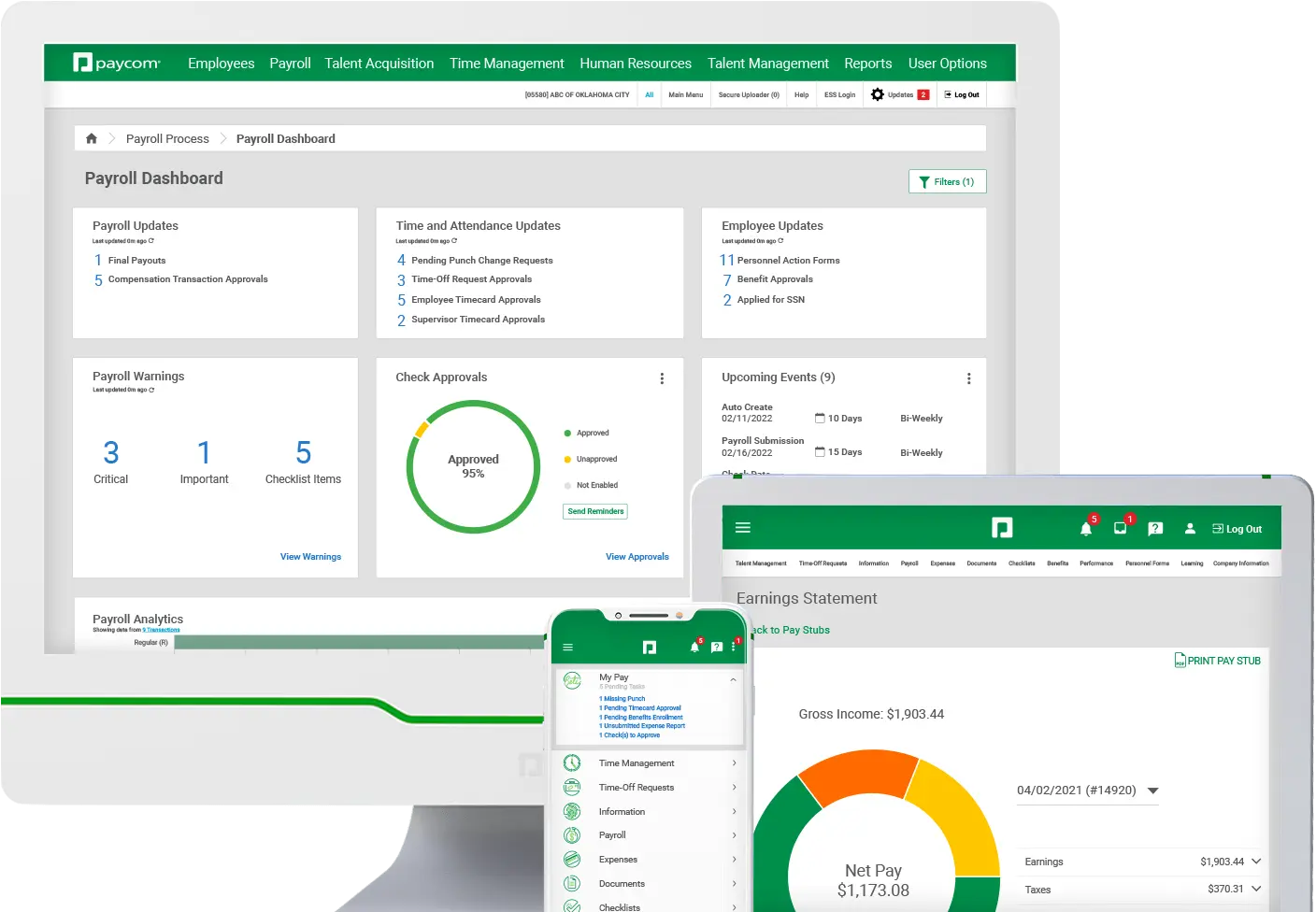

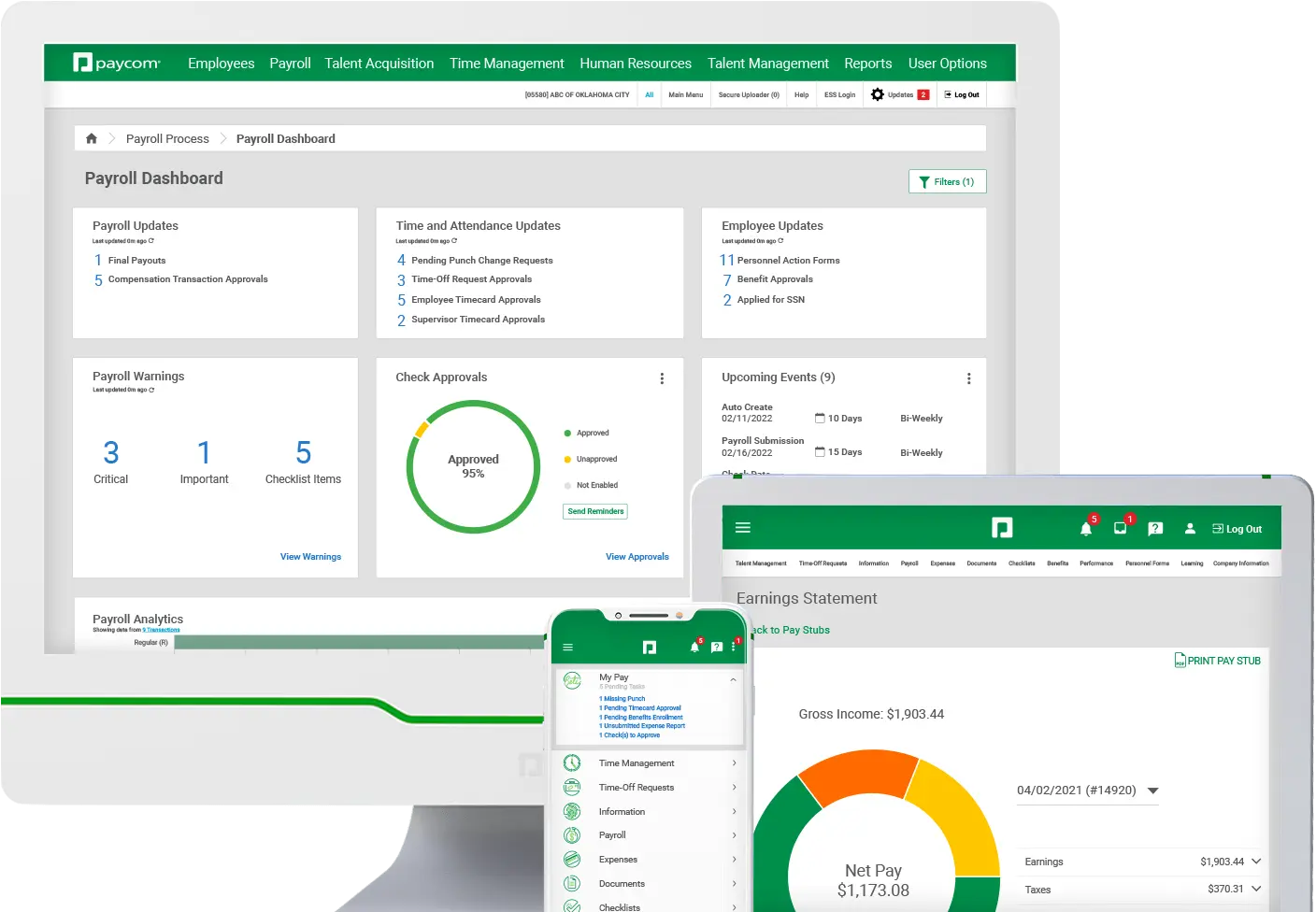

A full online payroll management system in a single software

Payroll is the core of Paycom because it’s why employees work. In return, they expect their pay to be on time and correct, whether payroll is issued through direct deposit, paper checks or payroll cards. With Paycom's comprehensive payroll software, you can meet your promise to your most important asset while streamlining processes for expenses, garnishments and more. That’s the power of one.

To your workforce, payroll that’s 99% right is 100% wrong, so why leave this critical function to human error? Our peace-of-mind online payroll processing software is designed for an easy and error-free experience each and every cycle.

Empowering employees to manage their payroll data does more than increase data accuracy. It sets the stage for a culture of trust, autonomy, productivity and innovation, strengthening your employer brand as a top workplace.

From handling garnishments to issuing checks off our account instead of yours, our online payroll services eliminate manual processes and multiple systems to help protect your organization from risk of penalties and lawsuits.

PAYROLL SOFTWARE AT A GLANCE

*Available in the U.S., Mexico, Canada and the United Kingdom

Beti®

Now employees do their own payroll with a guided self-service experience.*

Vault

Unlock payroll convenience for employees with a pay card option.

Everyday™

Give employees more flexibility with the option to be paid daily.

Paycom Pay®

Avoid the laborious task of reconciling payroll checks by using our account.

GL Concierge

Keep payroll accounting data fast and simple with general ledger consolidation.

Expense Management

Easily reimburse employees’ expenses with an automatic data flow to payroll.

Garnishment Administration

Let us manage wage garnishment orders to help lower your liability.

Payroll Tax Management

Ease the stress of payroll tax responsibilities, from conversion to balancing.

Explore more tools in our single software

Explore more tools in our single software

PAYROLL SOFTWARE SERVICES WITHOUT THE STRESS

Over 6.5 million Americans rely on Paycom’s technology every year

“The biggest and best thing that came from Paycom is our payroll process. We went from 80 hours of payroll a week to 5.”

HR director

Payroll solutions for every industry

Paycom simplifies life for employees while meeting clients’ payroll processing needs, regardless of their organization’s size or industry. And with pay cards and the option to pay employees daily, our payroll software has features that benefit workforces of all types. Our software supports small family-owned businesses and enterprise organizations alike.

A payroll company you can trust

Getting paid is why employees work, so you can’t afford to get payroll wrong. Paycom puts payroll accuracy in the hands of the people who know their pay best — your employees. With our tool Beti®, employees are guided to find and fix payroll errors before payroll runs, so you and your employees can trust payroll is right every time.

With Paycom, you don’t need to worry about compliance and data security. Our team of experts can manage the reporting and filing process on your behalf, lightening the load of corporate tax season. And our comprehensive security standards and technologies are formally audited and ISO- and SOC-certified.

Explore these resources for greater online payroll services insight

FREQUENTLY ASKED QUESTIONS

Learn more about what our payroll software does for businesses

As an employer, you could run payroll without HR and payroll technology, but it’s a highly manual process that requires you to:

- track time and attendance for each employee

- ensure and maintain accuracy for compliance and audits

- issue a check for each employee

- and much more

By automating and streamlining payroll for employees with the right HR and payroll tech provider, you’re relieved of nearly all its administrative burdens, leaving you free to focus on what you do best. What Paycom does best is ensuring the accuracy and timeliness of your payroll every cycle, to help lower your liability and enhance the employee experience.

But how do you find the right provider? Our white paper, 7 Tips to Evaluate HR Technology, offers points to consider when looking for the best long-term, comprehensive fit for your organization.

Not all payroll software is created equal. First and foremost, consider ease of use as your No. 1 priority; in fact, research shows if employees find workplace tech difficult to use, they’ll stop using it.

That’s hardly the only thing to consider. Before purchasing, you should perform due diligence to understand the differences among providers and how each technology:

- impacts culture and engagement

- supports your employer brand and hiring strategy

- prepares you for audit-readiness

- commits to your success through service

For more information on each point and what to ask, download a free copy of our white paper, 7 Tips to Evaluate HR Technology.

With the right payroll software, you don’t just receive a return on your investment, you gain a steadfast partner dedicated to the success of your organization and its employees.

In addition to the considerations discussed in our white paper, 7 Tips to Evaluate HR Technology, today’s businesses need payroll and HR software that:

- grows with your business

- offers robust, customizable reporting

- contains all functionality in one app with one login and password

- provides dedicated client support with no phone trees

- employs industry-best security standards to safeguard your data

Request a meeting and we’ll help you make this important decision — not only for the generations in your workforce today, but for those to come.

With Paycom’s HR and payroll software, your employees are empowered to take ownership of their payroll. After all, with our single software, they also can manage their timecards, benefits, expenses, vacation requests … basically every important HR task that makes up payroll. And upon approval, all that data automatically flows to payroll, eliminating any need for reentry.

Quite literally, no one stands to lose more from inaccurate payroll than employees. That’s why for each scheduled payroll cycle, our award-winning payroll experience, Beti®, not only automatically identifies errors, but guides employees to resolve them before submission, so you don’t have to.

This transparent process:

- improves payroll accuracy

- reduces employer liability

- increases process oversight

- gives employees confidence in their paycheck

- decreases the number of hours spent, if not days

- lowers the amount of manual checks and general ledger voids

- reduces fees for payroll corrections or insufficient funds

- alleviates administrative duties of payroll and HR staff

Additionally, when you process payroll with Paycom, we can automate the management of payroll taxes — from conversion and balancing to submitting them on your behalf — for compliance peace of mind.

For employees not using direct deposit, we can eliminate the tedious job of check reconciliation after each payroll cycle by issuing paper checks off a Paycom bank account instead of your organization’s. That way, you don’t have to monitor every cent going out the door. We’ll even notify you of any check left uncashed after 180 days.

For new clients, we create custom converters so your data from other service providers will import successfully into Paycom, but we do not integrate specifically with other providers.

For accounting, you can generate perfectly mapped general ledger reports for direct import into your accounting software through our customizable GL Concierge tool.

Other providers may acquire or partner with third-party software for a patched-together product whose pieces don’t always speak the same language, which can result in duplicate tasks, inaccurate data and inconsistent reporting.

Not us! Our tools live in one software — built at Paycom, by Paycom — to ensure a seamless user experience.

Payroll software reduces the time needed to process payroll and improves the accuracy of paychecks, helping build trust with employees. The features of payroll software may include digital time tracking for hourly workers, time-off accruals and reporting, integrations with benefits centers and elections, tax deductions and much more.

With Paycom’s integrative software, payroll managers have access to all payroll information and records in one cohesive digital architecture.

Whether you need to run payroll for one employee or 1,000, accuracy and timeliness matter. Paycom houses employee payroll information such as benefits elections, direct deposit account information, garnishment management, payroll cycles and more. The process depends on the organization’s needs but can be as simple as checking information and approving amounts. It’s that easy!

For all your payroll needs in a single software, request a meeting