Tax credits

Easily reduce or eliminate your federal income tax liability

software overview

More savings, less burden

Who said securing Work Opportunity Tax Credits (WOTC) had to be hard? With our Tax Credits software, helping your company save doesn’t have to cost you sleepless nights. It finds, secures and administers eligible tax credits — potentially saving your company thousands without piling more on your workload.

Stress-free screening

Take advantage of federal incentives for hiring from certain groups facing barriers to employment. We help ensure you don’t miss out.

Cut your tax liability

WOTC offers a dollar-for-dollar reduction — not a deduction — on your organization’s federal income tax return.

How it works

An easier way to boost your bottom line

Just because WOTC is complex doesn’t mean qualifying for it should be. We’ll handle the bulk of implementing your WOTC strategy for you. Our tax experts work so eligible clients benefit from 100% of all tax credits we secure. Meanwhile, you can stress less and enjoy the lower federal income tax liability.

Easy to start

Simply add a candidate to our Tax Credits tool and Paycom’s WOTC team will manage the process from there.

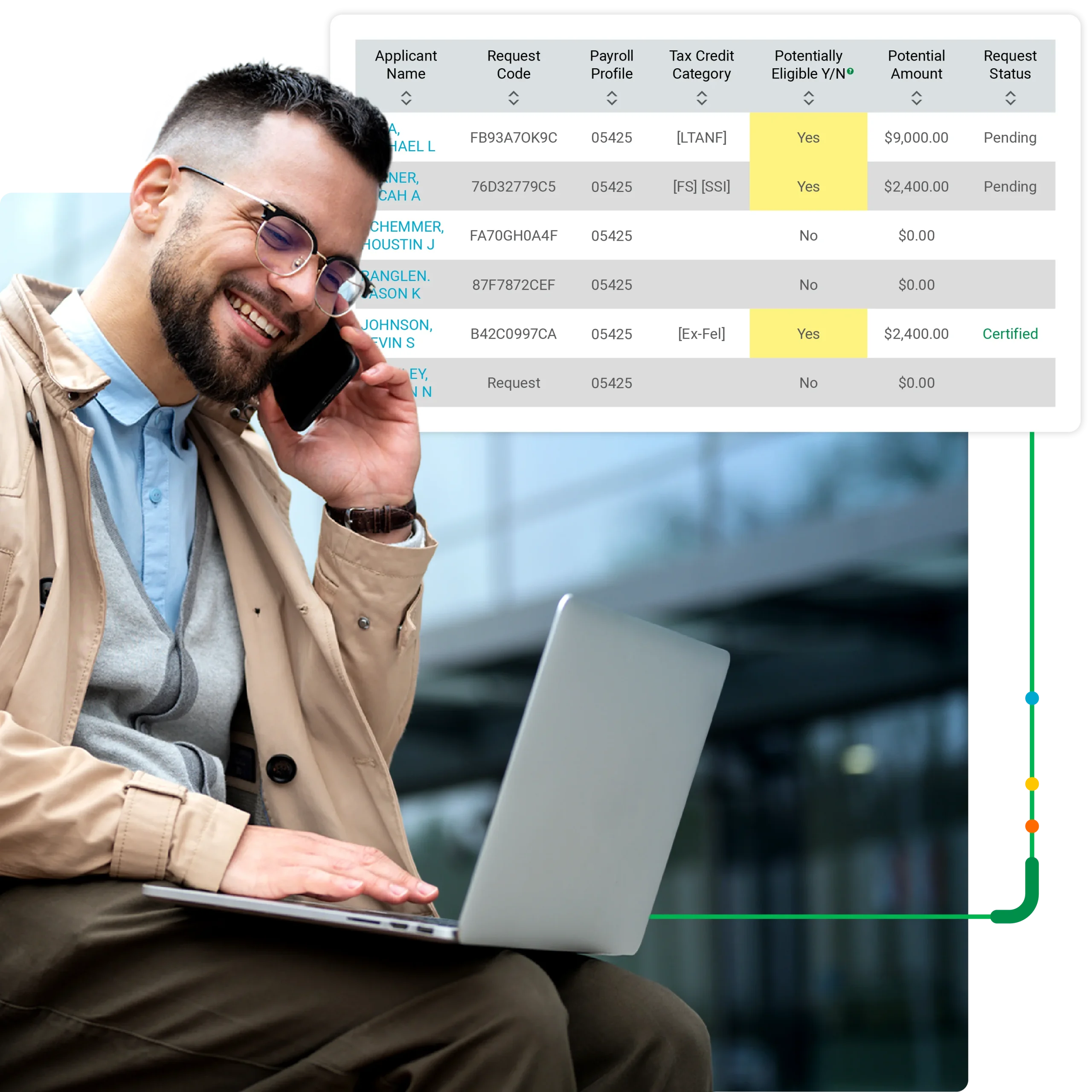

Instant insight

For each candidate, our Tax Credits dashboard allows you to instantly see their potential eligibility and amount.

No hits? No problem.

If we’re unable to locate any credits, you pay nothing for our search. It’s that simple.

Our Tax Credits software finds per-employee incentives, including:

- Long-Term Temporary Assistance for Needy Families (TANF), up to $9,000

- Supplemental Nutrition Assistance Program (SNAP) recipient, up to $2,400

- Short-Term Temporary Assistance for Needy Families (TANF) recipient, up to $2,400

- Unemployed Veteran Credits, up to $5,600

- Disabled Veteran Credits, up to $9,600

- Ex-Felon Credit, up to $2,400

Why it matters

How a Fast-Food Franchise Saved $447,000 Through Hiring Tax Credits

The CFO of a Kansas-based food franchise knew there had to be a better way to make the most out of hiring. And they were right. With Paycom, the company secured the equivalent of selling 5.5 million burgers in tax credits.

“What we annually qualify for in tax credits is more than the equivalent of one of our restaurants working 12 months.”

—CFO

See what people are saying about tax credits

Frequently Asked Questions

Learn more about WOTC and HR compliance

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to businesses that recruit and hire candidates who often face barriers to employment. Employers may meet their staffing needs and claim a tax credit by hiring a candidate in a WOTC-targeted group.

Tax credit software is technology that helps businesses verify if a candidate or employee may allow their employers to qualify for WOTC. While tax credit software can’t guarantee a specific tax deduction, it can help employers uncover opportunities to lower their tax liability.

Tax credit software helps HR pros simplify the process of determining if a candidate qualifies their organization for WOTC. In turn, you avoid time-consuming manual work and benefit from enhanced and cost-effective recruitment.

Paycom’s tax credit software supports your business by giving you confirmation of your WOTC eligibility. This gives you greater insight into your overall budget, as well as how your business may grow and adapt. It can also inform where you focus your hiring efforts. In other words, Paycom’s tax credit software eliminates the tedious work, so you can better focus on your company’s big picture.

Paycom helps employers reduce their tax liability by automatically searching for potential credits when a candidate enters our Tax Credits tool. In certain cases, employers who qualify for WOTC eliminate their federal tax liability outright.

Yes! If a candidate you’ve entered qualifies for one or more tax credits, you’ll automatically receive a notification detailing each credit. No need to manually check for a result.

Beyond entering the candidate into our Tax Credits software, none! We’ll handle identifying, securing and administering any available credits. Plus, if we don’t find a qualifying tax credit, you pay nothing for our search.

You can claim credits on your year-end tax return, but not through a monetary payment. Paycom provides a year-end statement with all of the tax credits secured in that year. We recommend you provide this statement to a CPA or equivalent tax professional for filing.