The payroll and HR tech that grows with you in a single software

36+

tedious payroll and HR tasks eliminated

2,600+

hours saved per year*

1,000,000+

5-star ratings on the app

6.5M+

Paycom users

36+

tedious payroll and HR tasks eliminated

2,600+

hours saved per year*

1,000,000+

5-star ratings on the app

6.5M+

Paycom users

*A commissioned Total Economic ImpactTM study conducted by Forrester Consulting on behalf of Paycom, June 2023.

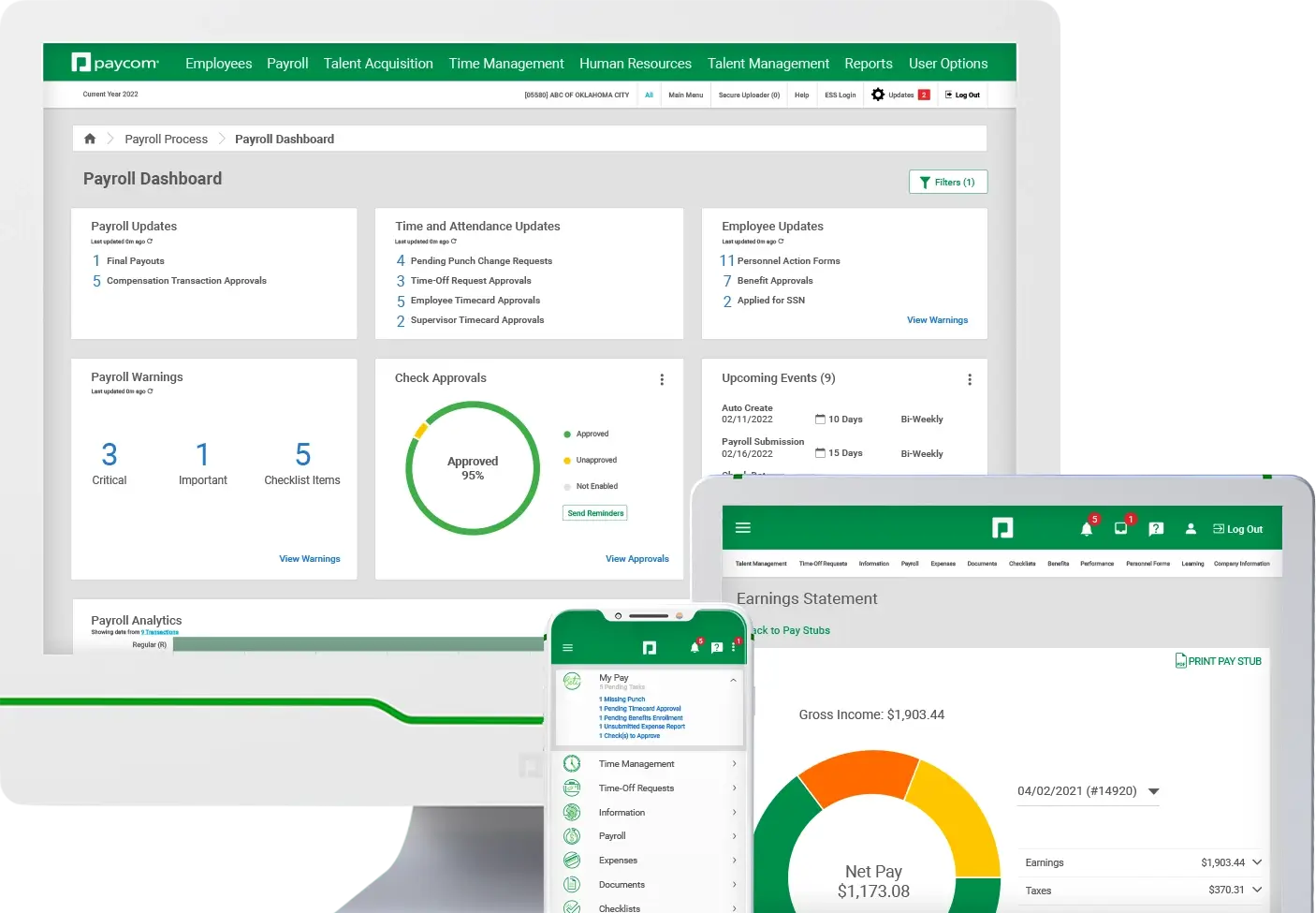

Automated payroll designed for growing business

More employees shouldn't mean more HR headaches

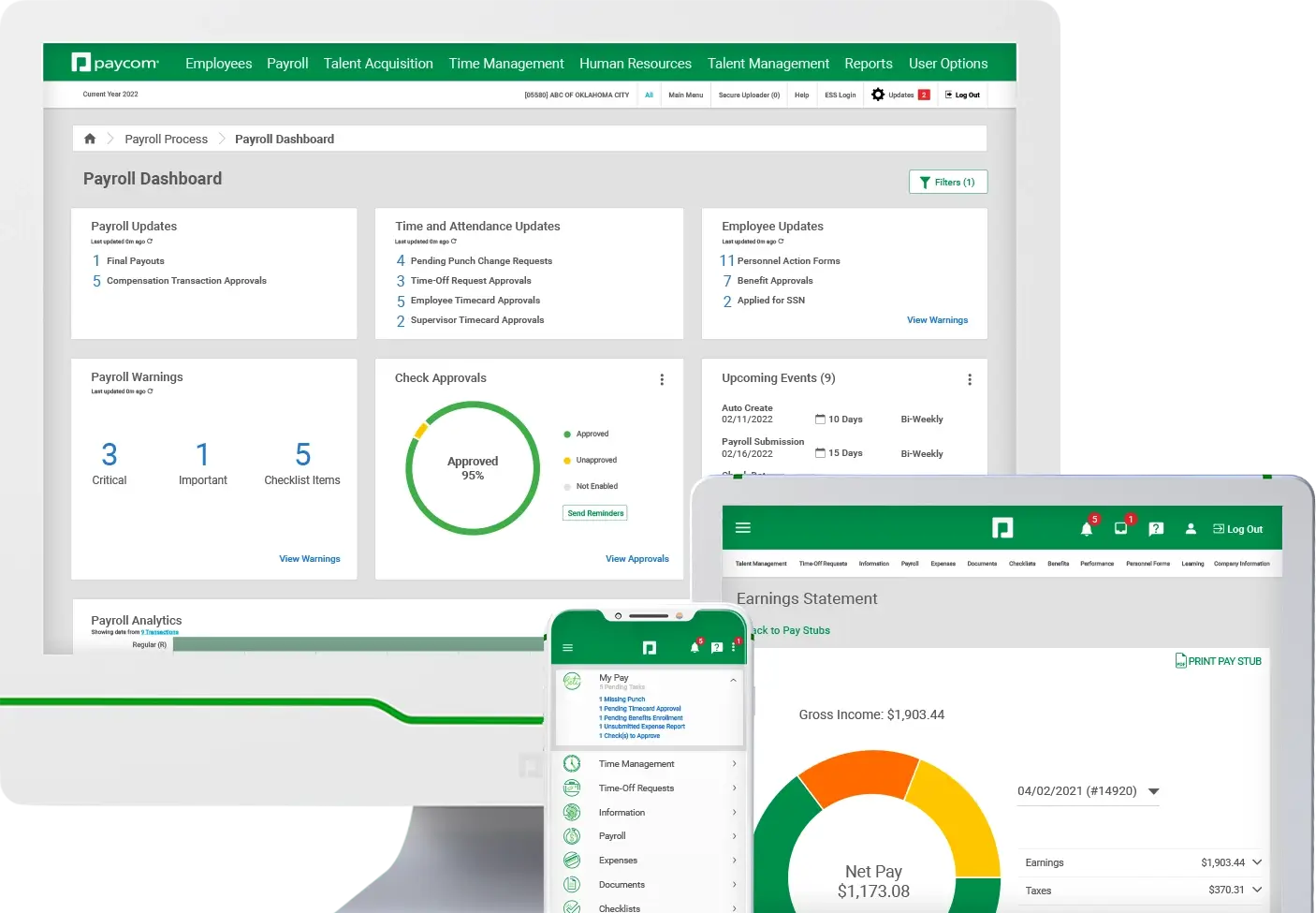

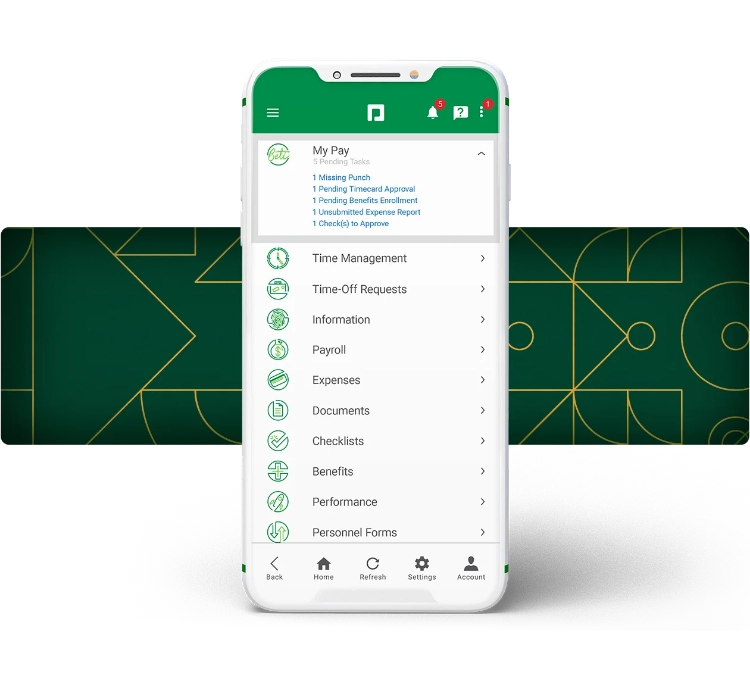

Midsize businesses have unique HR and payroll needs. Empower your team to manage their own paychecks and take the pain out of payroll. It's easy for employees to update and access everything they need in a single app; from benefits and expenses to tax setup and PTO. Errors are identified and fixed before payroll submission, giving HR teams back more time to focus on business growth and other priorities. See how our payroll software for midsize businesses brings peace of mind.

Comprehensive HR tech maximizes growth, minimizes risk

Choose an HCM software that's designed to grow with you. By centralizing employee data transfer and confirmation into one system, employees are more engaged and compliant. This minimizes your company's risk, even as it grows. Robust reporting options also give you full control and transparency, ensuring you are equipped with the data you need to make more informed decisions. See how our HR software for midsize businesses delivers a streamlined experience.

Bridge the gap between employees and their data

Automate your HR processes — from recruiting and onboarding to employee development, benefits administration, document management and more — and boost productivity.

Industry resources for midsize businesses

Tackle your toughest HR challenges with these resources

For all your midsize business payroll and HR needs, rely on Paycom.