Garnishment Administration

With wage garnishment management software, help reduce your company’s liability by sending your orders to us

HOW YOU BENEFIT

Help lower your organization’s liability with garnishment administration software

Garnishments are a risky business. Failure to comply can result in facing multiple citations and severe financial penalties. In fact, employers may be held liable for the full garnishment amount, plus litigation costs and other expenses, as a result of a simple calculation error or late answer. But with Paycom’s Garnishment Administration software, you simply notify us when an employee is subject to garnished wages and we’ll handle the calculations, payments and record-keeping.

Our garnishment specialists alleviate the headache of administering garnishments by handling them from receipt of the order to the last payment or expiration and everything in between — all so you don’t have to.

Paycom reconciles all payment amounts, calculations and third-party payees. We also administer and send payment and other documentation, completed answer sheets and additional paperwork as specified in the order. Each pay period, all garnishment deductions are tracked and recorded in our software.

Rest assured, our garnishment specialists work in tandem with your dedicated Paycom specialist to provide communication with third-party payees regarding each order. Additionally, Paycom offers an optional, full-service garnishment support team dedicated to helping enhance your process.

Garnishment ADMINISTRATION WORKS WELL WITH

Payroll Tax Management

Ease the stress of payroll tax responsibilities for your organization, including conversion and balancing.

Explore these resources for greater payroll insight

FREQUENTLY ASKED QUESTIONS

Explore the ins and outs of Garnishment Administration

Paycom sends physical checks directly to the required agencies for full-service and mail-only clients. Paycom can also send electronic payments if the garnishment order allows it. Clients without our Garnishments Administration tool will receive physical checks with their payroll packet to mail themselves.

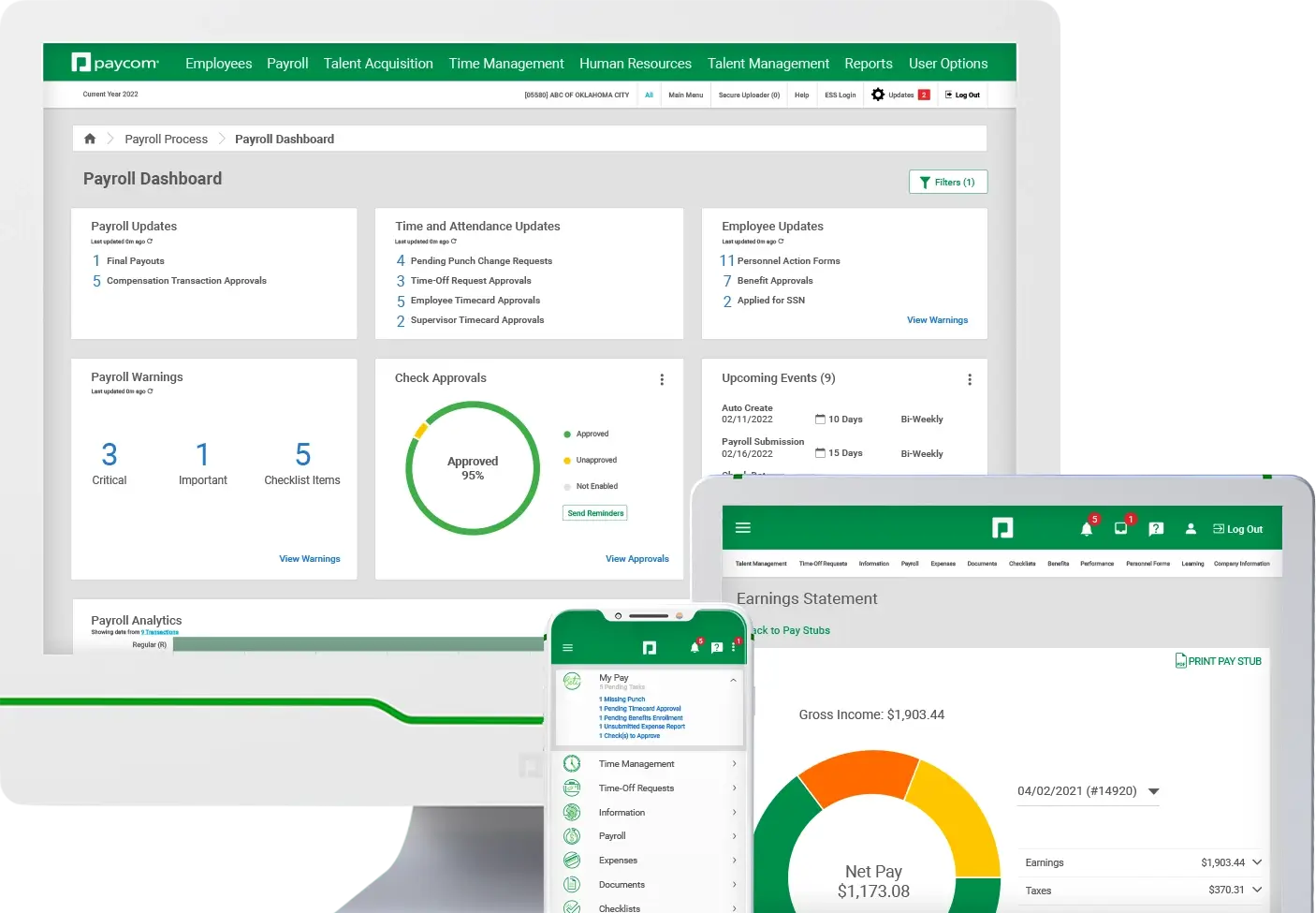

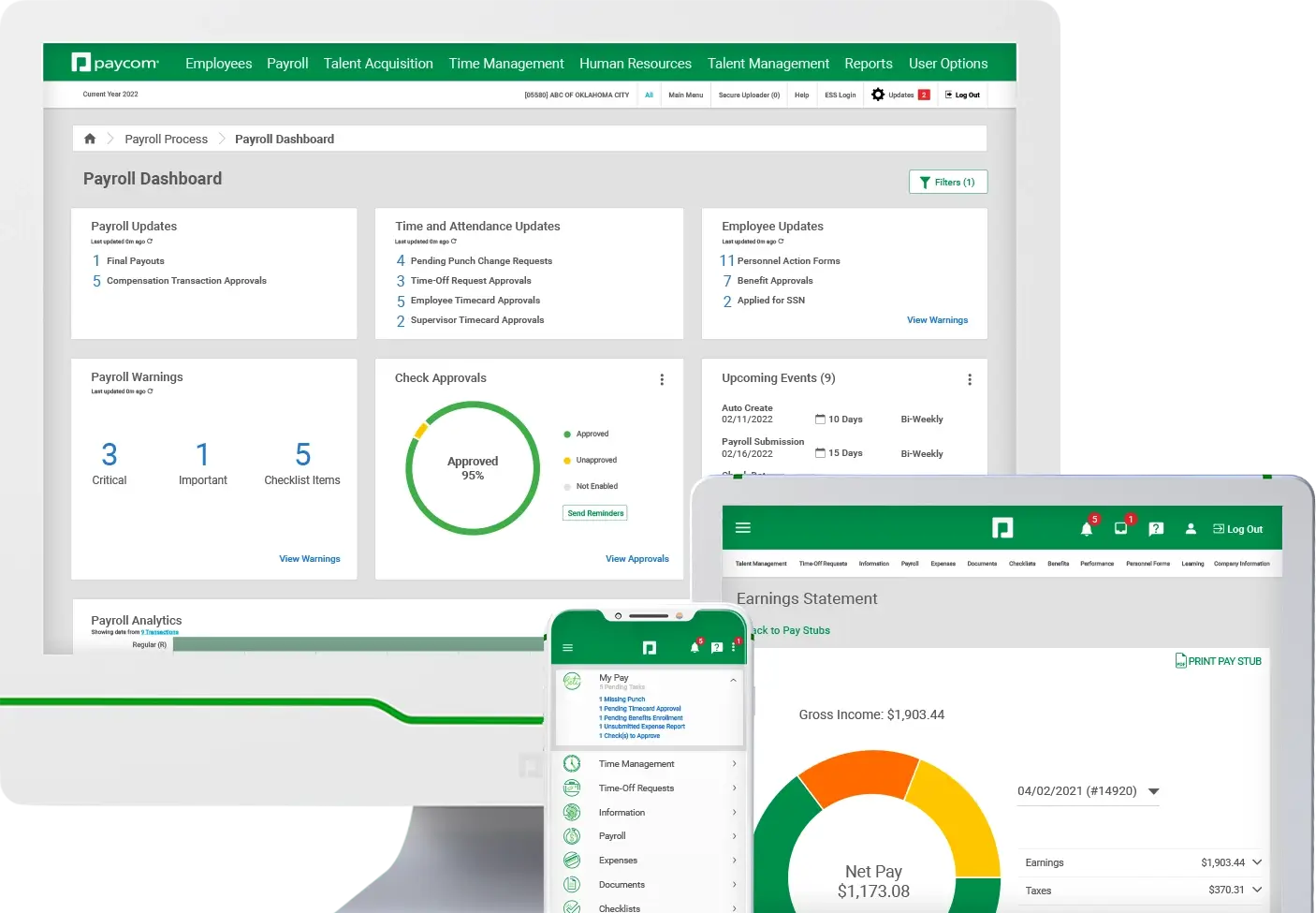

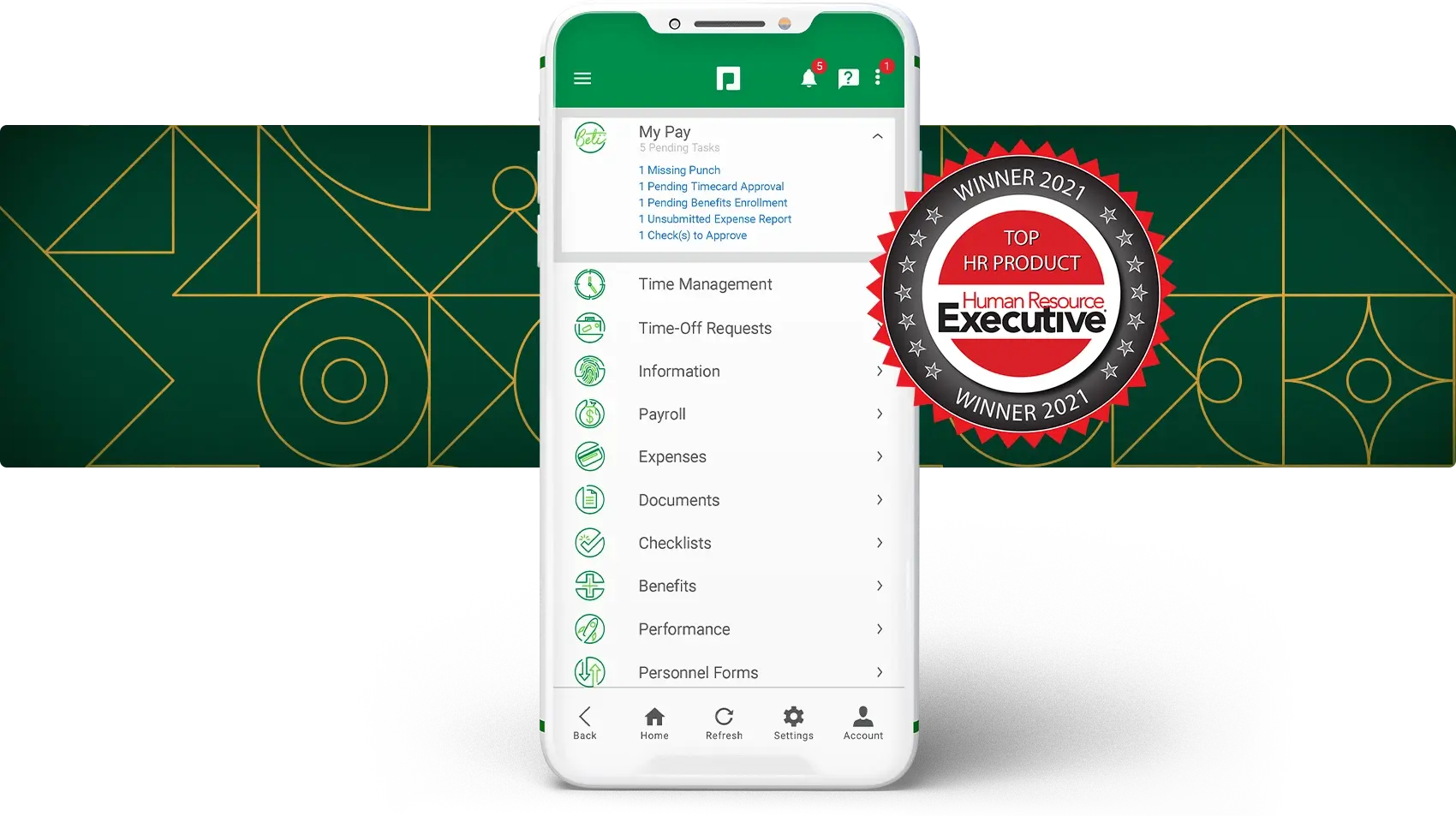

Full-service clients of our garnishments administration software have an option to make ongoing garnishments visible within their employees’ self-service mobile app. Employees who opt in will receive a notification once the garnishment has been processed. This allows employees to view an ongoing garnishment. While they won’t receive a notification when the garnishment ends, they can view whether the deduction is active at any time.

Yes, depending on the setup. Each state and garnishment order has its own rules, so certain triggers prompt a garnishment to stop or be removed from our Garnishment Administration software.

We set up several types of garnishments for each state with the option to run at the same time. However, state or federal rules can prevent certain garnishments from running simultaneously.

For all your payroll needs in a single software, request a meeting