In “7 Reasons to Get to Know Beti,” we took a look at the payroll-redefining benefits of our new automated tool, Beti®. With this industry-first experience, employees manage their own payroll, including updating timesheets, approving paychecks and owning their own data — all without having to contact their supervisor or HR. The best part? These processes can occur throughout the pay cycle, and as Beti sends reminders to resolve any outstanding discrepancies along the way, you’ll be looking at a perfect payroll come payday.

There’s no doubt that Beti is a great asset to the professionals who traditionally execute payroll, but it also delivers some clear benefits to payroll recipients. Today, I’d like to look at some of the more enriching ways Beti can benefit your employees.

Before Beti

In a pre-Beti world, the employee experience around payroll left room for improvement. According to one study, employers have to correct errors on four out of five employee timesheets. Unfortunately, when errors occur, they are usually found after payroll is finished, when employees get their paycheck. As tech-savvy consumers, we’re used to a certain level of user-friendly, online access to the app-based services we use in our personal lives. It’s not surprising employees carry the same expectations surrounding the applications driving their payroll. Why should HR tech lag behind in functionality?

Eliminating errors

Not only does Beti offer a host of benefits for employees, but it’s a way of handling payroll that just makes sense. For example, in most processes, when payroll discrepancies come to light, it’s not uncommon for them to be found by the employees themselves. So why not take that same attention and incorporate it within the payroll process — and early at that?

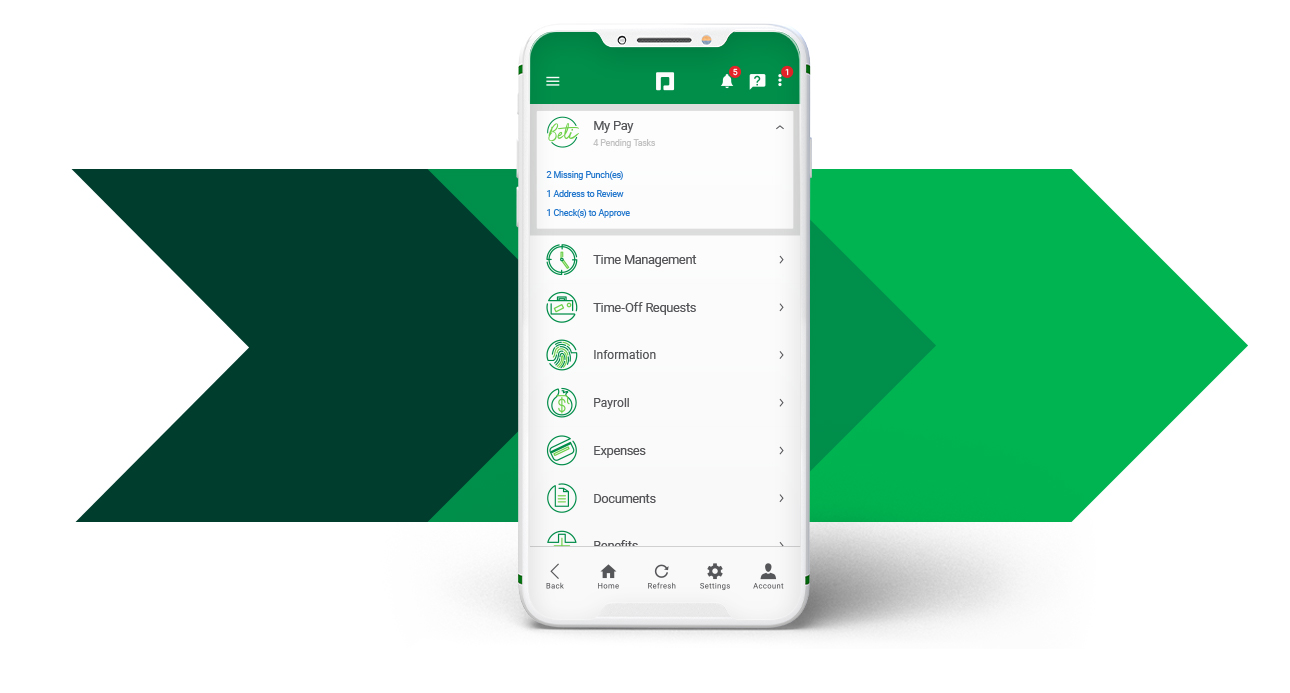

With Beti, employees are given the keys to not only troubleshoot and approve their paychecks; Beti allows them the opportunity to check the accuracy of the data they know best: their own! Employees already manage many of the other components of their paychecks, including timecards, expenses, PTO requests and benefits. Now they have the convenience within Paycom to process their own payroll as well.

By automatically notifying employees through the app to resolve concerns — including correcting missing punches — before their timecards are due, they help clear some of the most common (and time-consuming) obstacles from the payroll path.

By automatically notifying employees through the app to resolve concerns — including correcting missing punches — before their timecards are due, they help clear some of the most common (and time-consuming) obstacles from the payroll path.

Pre-payroll visibility of information isn’t just about catching discrepancies. While Beti does not allow employees to change their rate of pay, it does allow them to verify their data, where they gain full insight into the makeup of their pay, including deductions, allocations and other variables that determine their check-to-check compensation. Based on the responses of our pilot groups, employees are able to use the clarity Beti provides to better plan their personal finances. This unparalleled insight into their pay makes it easier to plan for the future and also reduces the likelihood of financial inconveniences like overdraft fees or missed payments that can arise from delays surrounding an incorrect paycheck.

Building trust

A benefit somewhat less tangible — but no less important — is the confidence that employees are able to take away from a Beti-managed payroll. When accurate, timely paychecks are the standard and unwanted surprises become a thing of the past, it builds trust in leadership that can encourage greater employee engagement. Plus, as the labor markets continue to heat up, having an asset like Beti can also set tech-savvy organizations up for recruiting success by offering a competitive advantage in the form of a more responsive and advanced employee experience.

Allowing employees to manage their own payroll means less work not only for the team handling payroll but also for the employees. Beti automates the process step by step, and when employees verify their data and resolve errors on the front end, it prevents time wasted on payroll corrections, voids and reversals. The CHRO/COO of a credit union with 150 employees described it best when he said, “Beti is giving ownership of payroll to employees and managers, which is great because they know better than anyone what their paychecks should be.”

To learn more about the next step in payroll evolution, visit Paycom.com/beti.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.