What does the phrase “employees do their own payroll” mean to you? Do you think of employees paying themselves whatever they want or adjusting their time-off balances as they see fit? If you’re used to paper-based payroll, it wouldn’t be hard to imagine workers literally cutting their own checks.

Of course, employee-driven payroll isn’t any of the above. Even with basic HR technology, there’s a decent chance at least some of your processes are employee-driven, i.e., “self-service.”

According to an HR.com survey commissioned by Paycom, a staggering 92% of HR professionals said their employees use self-service HR tech most commonly to:

- view payroll data

- update contact info

- request time off

- check PTO accruals

In fact, viewing payroll data topped the list at No. 1. What’s missing, however, is their ability to ensure it’s 100% accurate.

After all, if payroll — the process that impacts employees the most — is incorrect, it sabotages the advantage of every other self-service tool.

Payroll errors are more than just annoying

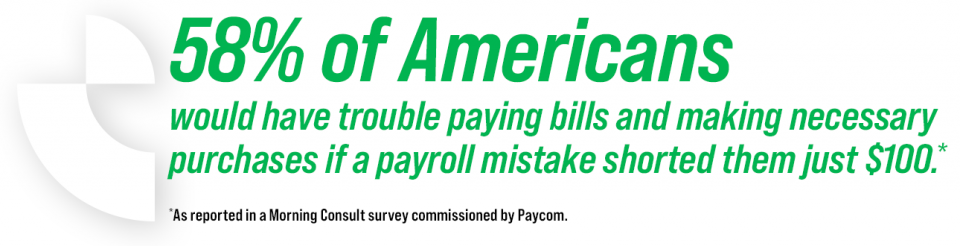

As reported in a Morning Consult survey commissioned by Paycom, 58% of Americans would have trouble paying bills and making necessary purchases if a payroll mistake shorted them just $100. The best HR tech allows employees to find and fix errors before payroll runs.

For those living on the brink of poverty, employee-driven payroll helps them anticipate expenses and plan their financial future.

Yet some still don’t see the need. Let’s explore some questions about employee-driven payroll and dive into why it’s invaluable for employees and their employers.

1. What is employee-driven payroll?

Employee-driven payroll is technology that empowers employees to do their own payroll. It doesn’t mean HR is no longer involved in the process or that employees can adjust their hours and salary as they see fit.

Instead, it helps employees avoid stress by guiding them to identify and resolve payroll errors before they require costly fixes like wires, voids, reversals and rushed paper checks.

By letting employees do their own payroll, businesses benefit from:

- lower liability

- stronger oversight

- improved data accuracy

- greater employee insight and confidence in the process

2. Employees aren’t HR professionals, so why would I want them to do their own payroll?

Ultimately, employees are the most familiar with their own data. They need payroll to be perfect more than anyone else. Their peace of mind is dependent on their pay’s consistency, and employee-driven payroll protects their well-being.

Ideally, employee-driven payroll carefully guides employees to perform only the actions they need to. HR professionals are still privy to the process — they just don’t have to painfully and manually complete it themselves.

3. Does employee-driven payroll mean employees can pay themselves whatever they want?

No, not with the right tech. Again, employee-driven payroll should guide employees to complete only necessary tasks like confirming their pay and correcting errors. There should be no opportunity for them to adjust their wages independently.

If an adjustment needs to be made, employees may easily contact the best person to help them through an easy-to-use communication tool. While this process makes corrections proactive rather than retroactive, they still require HR’s approval.

4. Will employees still get paid even if they don’t use it?

Employees work for their pay, so it’s unlikely they won’t want to ensure it’s right. But even if they don’t approve their check, payroll will still run to ensure they’re paid on time.

Still, once employees see how valuable employee-driven payroll is, they won’t want to return to an outdated process.

5. Does employee-driven payroll benefit salaried employees?

Salaried employees may not have to account for hours, but they’re still affected by:

- PTO

- taxes

- expenses

- commission

- reimbursements

- and more

Every employee has obligations. Just because they’re salaried doesn’t automatically mean they can afford a delayed or inaccurate check.

6. Why rock the boat when we don’t have payroll errors?

How do you know your payroll is perfect? Even if it’s technically accurate under an outdated process, new laws, taxes, benefits and the chance of human error while processing payroll present constant challenges.

Preventing payroll errors before employees are paid may help your company avoid wage and hour class-action lawsuits. While a business is still responsible to pay its employees accurately, employee-driven payroll helps it ensure this obligation.

7. Even if there’s a small payroll error, does it really hurt employees that much?

Absolutely. But don’t just take it from us. Try asking the 61% of Americans who live check to check, according to the Morning Consult survey. For millions, a payroll error or unexpected pay delay could make them:

- choose which bills not to pay

- cut back on groceries

- put off refilling a prescription

- delay their future plans

- endure high amounts of stress

Yet 28% of those same respondents say employee-driven payroll would increase the trust they have in their employer. No organization wants to damage their people’s well-being; employee-driven payroll helps ensure they don’t.

8. What if employees don’t understand employee-driven payroll?

Ideally, employee-driven payroll should be available through one HR software. For example, Beti® is accessible through Paycom, the single easy-to-use app employees use to manage all of their HR data. For them, doing their own payroll with Beti is as simple as using any of the tech they use in their personal lives.

With Beti, employees verify and approve their payroll in a matter of seconds. In the event of a missing expense or another error, Beti guides workers to correct the discrepancy themselves without forcing them to log into a separate piece of software. Should they need HR’s assistance, help is available through the same app using Paycom’s Ask Here tool.

Beti is the culmination of self-service HR tech’s functions. It’s an employee-driven payroll experience that guides workers to find and fix errors before submission — right in the Paycom app! Plus, HR professionals have insight into the entire process through an intuitive payroll dashboard.

Explore Beti to learn how it stops payroll problems before they’re problems.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.