It’s difficult to imagine any form of organized business without payroll. Yet tracking wages — and ensuring they’re consistent — wasn’t always as inherent as it is today. From sparse, handwritten records to self-service functionality, you’ll find the path of payroll continues to take exciting and innovative turns.

The first payroll

While the idea of compensation for goods or services is evident in humanity’s oldest documents and technology around 2500 B.C., the concept of payroll itself didn’t emerge until much later. The first evidence of tracked employee pay appeared alongside the early forms of bookkeeping in the 14th and 15th centuries. Roughly a hundred years later, during the 16th century, the prototypical payroll administrator arose in the form of the “paymaster,” whose job it was to ensure salaries were dispersed, primarily in the government and military.

However, even though all the pieces were there — including someone to manage it — the word “payroll” wouldn’t be implemented until as late as the mid-18th century. This term emerged as regular, monetary payments made toward an employee’s salary replaced compensation in the form of food, clothing and shelter. Though this definition of payroll remains largely unchanged, the way it is processed has evolved exponentially.

A constitutional impact

Many of the most significant payroll developments occurred in the first half of the 20th century, beginning with the introduction of the 16th Amendment. This established a federal precedent for income tax in 1909, which would inevitably be followed by the states, beginning with West Virginia’s sales tax 12 years later. Shortly thereafter, the Great Depression would illuminate Americans’ need for a financial safety net, spurring President Franklin D. Roosevelt to sign the Social Security Act into law in 1935.

Though businesses would work to comply with this law over the next decade, they were hampered by payroll processes that were tedious, inconsistent and entirely manual. This would improve in 1947, as General Motors would introduce its “automation department,” which included a rudimentary standard for payroll. This, combined with the advent of the desktop computer in the ’80s, would catalyze an entire industry of payroll providers. As new workplace technology emerged, these providers would design new ways to integrate such advancements into their systems.

Near the end of the millennium, the emerging popularity of the internet would transform the way we connect with one another everywhere, especially within business. And in 1998, Paycom would be the first to embrace this imminent digital reality by bringing payroll entirely online.

The self-service revolution

As online access and consumer technology evolve, so too does HR software. Likewise, today’s employee has come to expect the same level of convenience granted by their personal devices from their workplace tools.

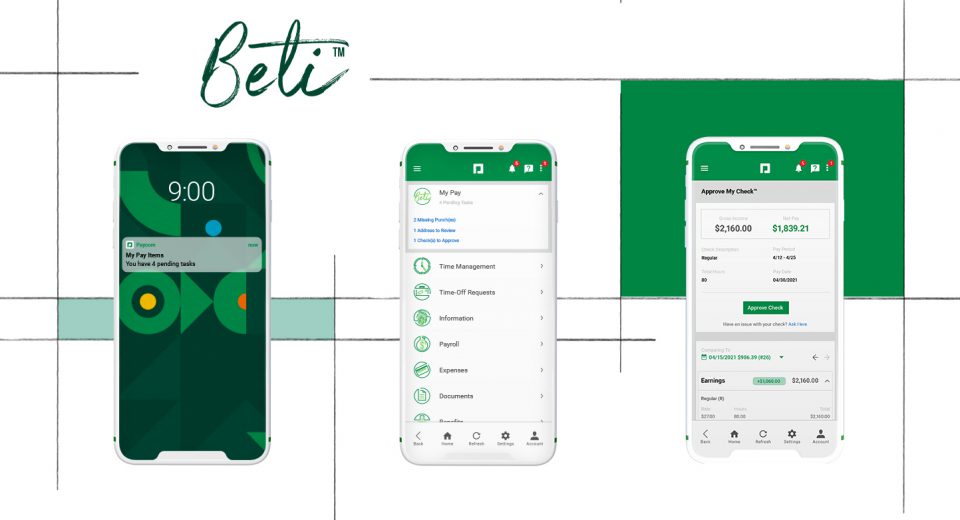

Paycom again sparks the next great leap in payroll functionality with Beti®, the industry-first, employee-driven payroll experience. By guiding employees to access, view, manage, troubleshoot and approve their own paychecks, Beti allows them to resolve errors before payroll runs.

This innovation caught the eye of several industry experts. For instance, Steve Boese, HR Technology Conference chair and co-host of the HR Happy Hour podcast, wrote that Beti addresses the fundamental “backward-facing” issues that have plagued the payroll process. And in a recent webinar, famed investor Barbara Corcoran explained that by putting employees in control of their payroll, Beti leads to “less mistakes, less steps, less confusion” and, ultimately, “less redundancy.” Finally, Human Resource Executive® magazine named Beti a Top HR Product for 2021, positioning self-service payroll as the new standard for the process.

With Beti, the future of payroll is now. Learn more about how this innovation can elevate your business and view our HR:evolution series to see more quick, engaging insights into the history of HR.

DISCLAIMER: The information provided herein does not constitute the provision of legal advice, tax advice, accounting services or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional legal, tax, accounting or other professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation and for your particular state(s) of operation.