Payroll Tax Management

Lighten your compliance workload with our payroll tax software

What it does

End your payroll tax headaches

Managing payroll taxes is often complicated, time-consuming and undeniably stressful. What if you could clear your plate of these responsibilities while also lowering your company’s liability? It’s easier than you think. With our Payroll Tax Management service, you just submit your payroll and we handle the rest. You won’t have to calculate a payroll tax rate ever again.

Easy collection

We’ll automatically debit your payroll taxes when necessary, no matter your company’s size.

Stress-free remittance

Say goodbye to a calendar full of IRS deadlines. We’ll pay your taxes on time, every time.

Fluid filing

Federal or state. Quarterly or annual. It doesn’t matter what payroll taxes you have. We’ll file them online for you.

How it works

World-class service to stop your tax panic

When it comes to payroll taxes, even a qualified pro like yourself could use backup. And you won’t need to wait for us to catch up, either. We’ll simplify your tax burden from the moment you start using Paycom.

Mid-quarter? No problem.

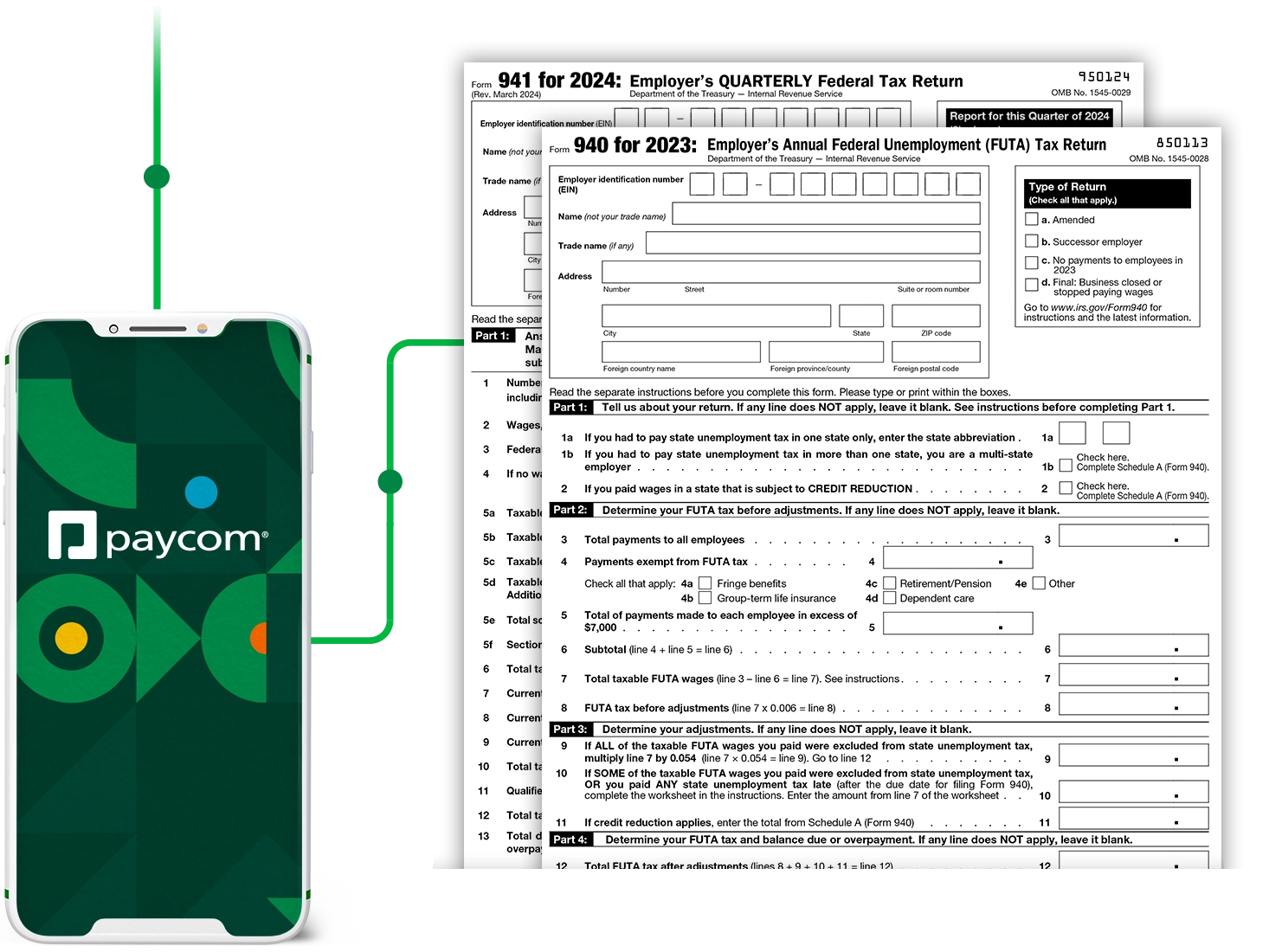

You shouldn’t have to stop for help. Even if you’re in the thick of tax season, we’ll easily handle quarterly returns like Form 941.

No-fuss FUTA compliance

Tired of juggling unemployment tax work? We’ll take care of your Form 940 even if a previous provider started it.

Perfect year-end

Dreading year-end responsibilities? We make it painless by converting and balancing all your year-to-date payroll tax totals.

See what people are saying about Payroll Tax Management

Comprehensive Convenience

Payroll Tax Management works seamlessly with

Beti®

Our self-service payroll experience ensures error-free paydays, so you’ll know your payroll tax data is perfect, too.

With taxes out of your hair, make your payroll duties even easier. This tool simplifies reconciling payroll account data with your general ledger.

Want to reduce your liability even more? With Paycom Pay, employee paychecks clear off our bank account, not yours.

Frequently Asked Questions

Learn more about payroll tax management software

Paycom helps alleviate the administrative burden of managing taxes on behalf of employers by collecting payroll taxes through debit and remitting them by their due dates. We also file quarterly federal and state tax returns online.

Paycom handles employers' quarterly Forms 941 and annual Forms 940. We also convert and balance all year-to-date payroll tax totals.

Yes! Even if you begin using Paycom’s payroll tax management tool mid-quarter, we’ll handle your quarterly returns. We’ll also handle your annual Forms 940, even if someone else filed it earlier in the year.

Through Paycom, employees have the option to receive their Form W-2 digitally through our self-service app. If employees opt for a paper copy of their W-2, the form is mailed to their employer directly. Our clients are responsible for distributing paper Forms W-2 to their employees.

Discover more about Paycom